Institutions

INSTITUTIONAL PRODUCTS

WHO WE SERVE

Crypto solutions for institutional investors

Integrate and build with our suite of APIs to offer your clients a premium crypto experience

How Gemini supports Institutional Investors

Hedge Funds

Enjoy fast and efficient access to trading and liquidity and benefit from asymmetric risk in your niche market. Our tight spreads, deep liquidity, and fast execution are available across multiple products accessing both spot and derivatives trading.

Hedge Funds

Enjoy fast and efficient access to trading and liquidity and benefit from asymmetric risk in your niche market. Our tight spreads, deep liquidity, and fast execution are available across multiple products accessing both spot and derivatives trading.

Hedge Funds

Enjoy fast and efficient access to trading and liquidity and benefit from asymmetric risk in your niche market. Our tight spreads, deep liquidity, and fast execution are available across multiple products accessing both spot and derivatives trading.

ETFs and Closed-End Funds

Launch with a trusted partner with deep experience supporting funds just like yours. We’ll guide you through the steps to build your ETF or closed-end-fund, with the optimal mix of trade execution, settlement, custody and other capital markets services through a regulated, secure, and trusted crypto-native platform built for institutions.

ETFs and Closed-End Funds

Launch with a trusted partner with deep experience supporting funds just like yours. We’ll guide you through the steps to build your ETF or closed-end-fund, with the optimal mix of trade execution, settlement, custody and other capital markets services through a regulated, secure, and trusted crypto-native platform built for institutions.

ETFs and Closed-End Funds

Launch with a trusted partner with deep experience supporting funds just like yours. We’ll guide you through the steps to build your ETF or closed-end-fund, with the optimal mix of trade execution, settlement, custody and other capital markets services through a regulated, secure, and trusted crypto-native platform built for institutions.

Asset Managers

Establish your market presence before the competition with crypto-native technology that enables you to grow fast and at scale. Differentiate with the ability to offer both fund or separately managed account (SMA) based products leveraging electronic OTC trading for optimal price execution at high volumes. All built on Gemini’s highly secure and regulated crypto platform for institutions.

Asset Managers

Establish your market presence before the competition with crypto-native technology that enables you to grow fast and at scale. Differentiate with the ability to offer both fund or separately managed account (SMA) based products leveraging electronic OTC trading for optimal price execution at high volumes. All built on Gemini’s highly secure and regulated crypto platform for institutions.

Asset Managers

Establish your market presence before the competition with crypto-native technology that enables you to grow fast and at scale. Differentiate with the ability to offer both fund or separately managed account (SMA) based products leveraging electronic OTC trading for optimal price execution at high volumes. All built on Gemini’s highly secure and regulated crypto platform for institutions.

Why Institutional Investors choose Gemini

Robust Security including strong encryption, hot and cold wallets, DDoS protection, MFA, and regular security audits.

Transparent & regular updates on key exchange metrics and compliance certifications.

Fiduciary and qualified custodian under the New York Banking Law.

Licensed by the New York State Department of Financial Services (NYDFS).

White glove service available

Our client solutions team will guide you through the account creation process and help you choose the right mix of products and APIs to achieve your desired outcomes. We’ll hand-hold you through the onboarding process and address any questions

You are in good company

Products for institutional customers

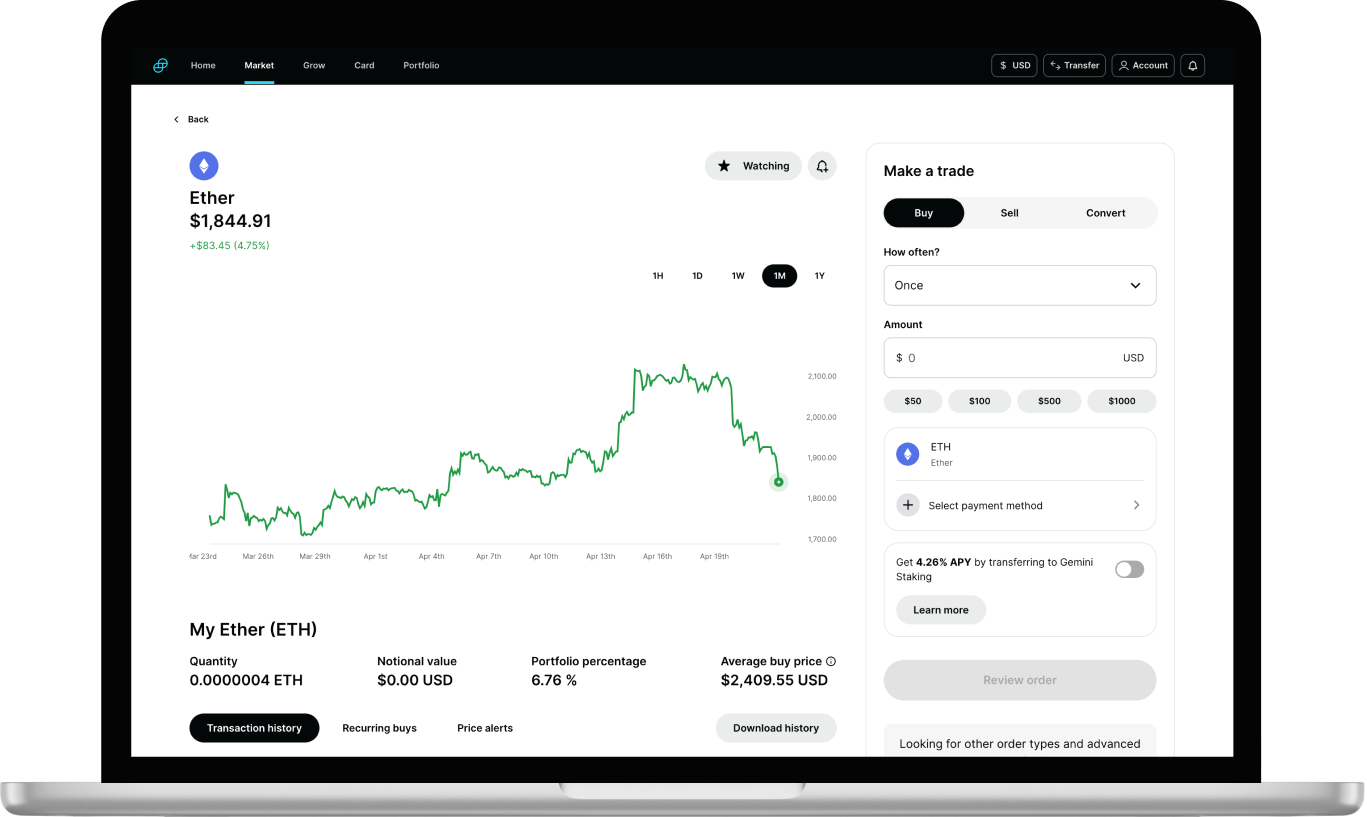

Gemini Spot and Derivatives Trading

Trade with confidence with advanced features for institutions on Gemini’s crypto-native platform

Gemini Spot and Derivatives Trading

Trade with confidence with advanced features for institutions on Gemini’s crypto-native platform

Features

ActiveTrader gives you all the tools you need to make informed trading decisions including real-time market data, advanced charting, cross collateral, and multiple order types.

Robust account management tools allow you to segregate your client’s portfolios or assign accounts to different managers or traders.

Integrate your trading systems to access order placement and real-time market data with our easy to implement exchange REST/FIX APIs.

Gemini Custody

Safeguard your digital assets with secure and regulated cold storage.

Features

Your assets are safe in offline storage systems that use multisignature technology, role-based governance protocols, and multiple layers of biometric access controls and physical security.

With the Gemini Instant Trade™ feature, you can trade directly on Gemini Exchange with assets held in offline (“cold”) storage.

Customized pricing aligned to the needs of your business. Gemini works with each customer to create tailored, unique price plans.

Gemini eOTC

Trade with deep liquidity for optimal price execution of large crypto orders.

Features

Orders are executed using the best price sources from top liquidity providers to pass on the tight spreads and deep liquidity to you.

Track multiple trade opportunities at once and execute with a single click, or use our APIs.

Maximize your capital’s efficiency and trading flexibility with delayed net settlement and intraday trading credit.