Blog home

WEEKLY MARKET UPDATE

MAY 02, 2024

Crypto Market Slides, Then Rallies After Federal Reserve Holds Steady

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic —this week we take a closer look at how interest rates work.

Crypto Movers

Crypto News

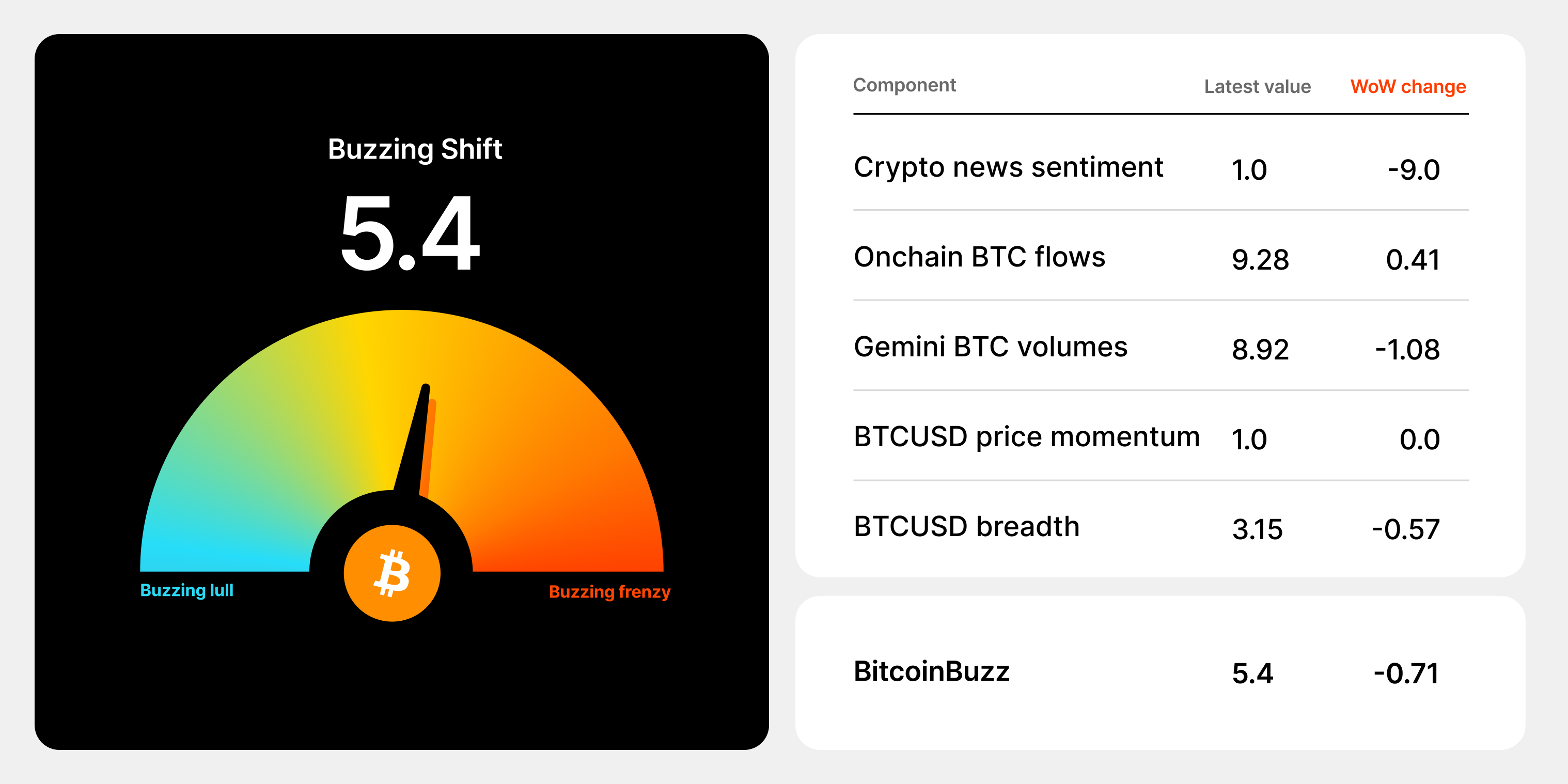

BitcoinBuzz Indicator

Topic of the Week

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, May 2, 2024, at 1:30pm ET. Check out the latest crypto prices here. All prices in USD.

Takeaways

- Crypto market tumbles, then rebounds after Fed meeting: The cryptocurrency market initially retreated under the shadow of renewed concerns about US stagflation. But Federal Reserve chair Jerome Powell left interest rates unchanged Wednesday at the latest FOMC meeting and downplayed stagflation risk, then crypto prices rallied.

- Changpeng Zhao, the founder of cryptocurrency giant Binance, receives four months in prison: Zhao pleaded guilty last year to violating money-laundering laws after criminals were allowed to use the exchange with no repercussions.

- The price of ETH drops amid SEC security classification concerns: ETH has declined over the past month. Now, new disclosures from a lawsuit show that the SEC may have considered ETH a security since 2023.

- BlackRock’s first tokenized asset makes waves: BlackRock's BUIDL fund, a pioneering tokenized asset initiative, has swiftly captured nearly 30% of the $1.3B tokenized Treasury market, outperforming competitors like Franklin Templeton’s BENJI offering.

- Major token unlocks set to infuse $4B into crypto market in May: This month will see an influx of $4B worth of tokens unlocked across various projects, with major contributions from Aevo, Pyth Network, and Ripple. The tokens could potentially drive market volatility and impact investor strategies.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Crypto Markets Slide Amid Stagflation Concerns and Gloomy Economic Data

The cryptocurrency market has retreated under the shadow of renewed concerns about US stagflation.

Federal Reserve chair Jerome Powell left the benchmark federal interest rate at between 5.25% and 5.5% at the latest FOMC meeting Wednesday, citing sticky inflationary pressures and a lack of recent progress toward their 2% inflation target. However, Powell downplayed the idea of needing additional rate hikes.

“It’s unlikely that our next policy move would be a rate hike,” Powell said.

Economic data revealed a slowdown in US GDP growth to 1.6% this quarter and a 3.4% increase in the PCE index – the Federal Reserve’s preferred inflation metric. However, Powell also downplayed the notion that stagflation had arrived.

“I don’t really understand where that’s coming from,” Powell said. “I don’t see the stag or the flation.”

After BTC had reached an almost two-month low at roughly $57,000 on Wednesday, the price rallied to $59,269.80 as of press time Thursday.

Binance Founder Changpeng Zhao Sentenced to Four Months in Landmark Case

Changpeng Zhao, the billionaire founder of Binance, received a four-month prison sentence Tuesday after pleading guilty to charges related to inadequate anti-money laundering measures. In a Seattle federal court, US District Judge Richard Jones emphasized Zhao's failure to comply with essential regulations despite having the necessary resources.

The sentence was significantly lighter than the three years sought by federal prosecutors, reflecting Zhao's cooperation with authorities, including a November plea deal that concluded a multiyear investigation.

Zhao also agreed to pay a $50M fine and stepped down as CEO as part of the settlement, although he retains a substantial ownership stake in Binance. Meanwhile, Binance continues to face legal challenges, including lawsuits from the SEC and the Commodity Futures Trading Commission.

ETH Prices Slip As Ether’s Status As Security Back in the Spotlight

The SEC has considered ETH a security since March 2023, according to the suit. That marks a stark 180 from public statements made by SEC chair Gary Gensler and other SEC officials who had suggested that ETH might not meet the criteria of a security because it’s decentralized.

The move comes just days after Consensys moved to preemptively sue the SEC ahead of the regulator’s upcoming enforcement action against the company. If the SEC successfully takes action against Consensys, it could have major implications for one of the most popular crypto wallets in the world.

BlackRock Dominates the Tokenized Treasury Market With BUIDL Fund

In just six weeks since launch, BlackRock's first tokenized asset fund, BUIDL, has rapidly grown to become the market leader in the tokenized Treasury sector, now holding nearly 30% of the $1.3B market.

Last week alone, BUIDL experienced an impressive $70M in inflows, surpassing Franklin Templeton’s BENJI offering, which saw minor outflows and currently manages $368M. This growth was significantly bolstered by Ondo Finance’s OUSG token, which uses BlackRock’s BUIDL as a reserve asset and attracted $50M in inflows.

The surge underscores the increasing interest in tokenizing real-world assets like US Treasuries, highlighting market appetite for this kind of product.

Crypto Speculators Expect $4B Worth of Tokens Will Be Unlocked

The cryptocurrency market could experience notable dilution and potentially further selloff as $4B worth of tokens from 21 different projects are set to be unlocked. This includes nearly $2.5B from just two projects, Aevo (AEVO) and Pyth Network (PYTH), which account for about two-thirds of the total anticipated unlocks.

Additionally, Ripple is expected to release 1 billion XRP tokens valued at approximately $500M. These could lead to increased market supply and possible price volatility, impacting investor strategy and market stability.

Prior token unlocks would suggest that at least some of these projects could face downward price movements in the aftermath of the unlocks, as investors seek to cash in new holdings.

-From the Gemini Trading Desk

BitcoinBuzz data as of 5:11pm ET on May 1, 2024.

To learn more about the BitcoinBuzz Indicator and its components, read our introduction here. Check back every week for an updated score!

How Do Interest Rates Work?

Lenders charge interest on loans for both individuals and corporations. Individuals borrow money to purchase big-ticket items like a home, car, or college tuition. Likewise, businesses use borrowed funds, or commercial debt, to fund their long-term projects and investments.

Banks also borrow money, often from individuals. When you deposit money at a bank you are effectively lending it to the bank in exchange for the bank paying you the going interest rate. Therefore, if interest rates are high and you’re a borrower, then your loan would be more expensive; but if you’re a lender, or saver, then you’d gain more profit from the higher rates.

What Determines Interest Rates?

A country's central bank generally sets the interest rate for their country or jurisdiction. In the United States, the Federal Reserve (the Fed) sets interest rates based on the “federal funds rate” or “overnight rate,” which is the rate that commercial banks charge each other to lend or borrow money in the overnight market. Banks use the current interest rate to determine what annual percentage rates (APR) to offer. An APR is almost always higher than an interest rate because it represents the accumulation of an entire year of interest rates as well as other costs like broker fees or closing costs. So if you’re comparing mortgage loans, the APR is the more accurate rate to consider.

The federal funds rate also forms the basis for the prime rate, which banks use for short-term products like variable-rate mortgages, auto loans, credit cards, and home equity loans. The prime rate is expressed as “Prime + a percentage,” and is generally about 3% higher than the federal funds rate.

A bank will usually offer individuals loans with different interest rates depending on an applicant’s individual level of risk. If a bank believes there’s a chance that a customer might not repay their debt, then it might not offer them a loan at all, or offer them a high interest rate. If a customer has a low credit score, then the bank will almost certainly offer that person a higher interest rate than it would for someone with an average credit score. A bank will typically offer its preferred customers, those with pristine credit records and the highest credit ratings, the prime rate.

Read more about interest rates

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

MAY 16, 2024

BTC Price Rallies on Cooling Inflation Data, Meme Stock Frenzy Returns, and State of Wisconsin Invests in Spot BTC ETFs

WEEKLY MARKET UPDATE

MAY 09, 2024

FTX Customers To Be Paid Back, Robinhood Receives Wells Notice, and Marathon Digital To Join S&P SmallCap 600

DERIVATIVES

MAY 02, 2024